How to Freeze Your Credit in Under 10 Minutes

By David V. | 10/14/2025

🔒 How to Freeze Your Credit in Under 10 Minutes

Identity theft is on the rise — but freezing your credit is one of the easiest ways to stop scammers from opening accounts in your name. It’s free, takes less than 10 minutes, and gives you long-term protection.

Here’s how to do it at all three major credit bureaus — Equifax, Experian, and TransUnion.

🧠 What You’ll Need

- Full legal name

- Social Security Number

- Date of birth

- Address history

- Access to your phone or email for identity verification

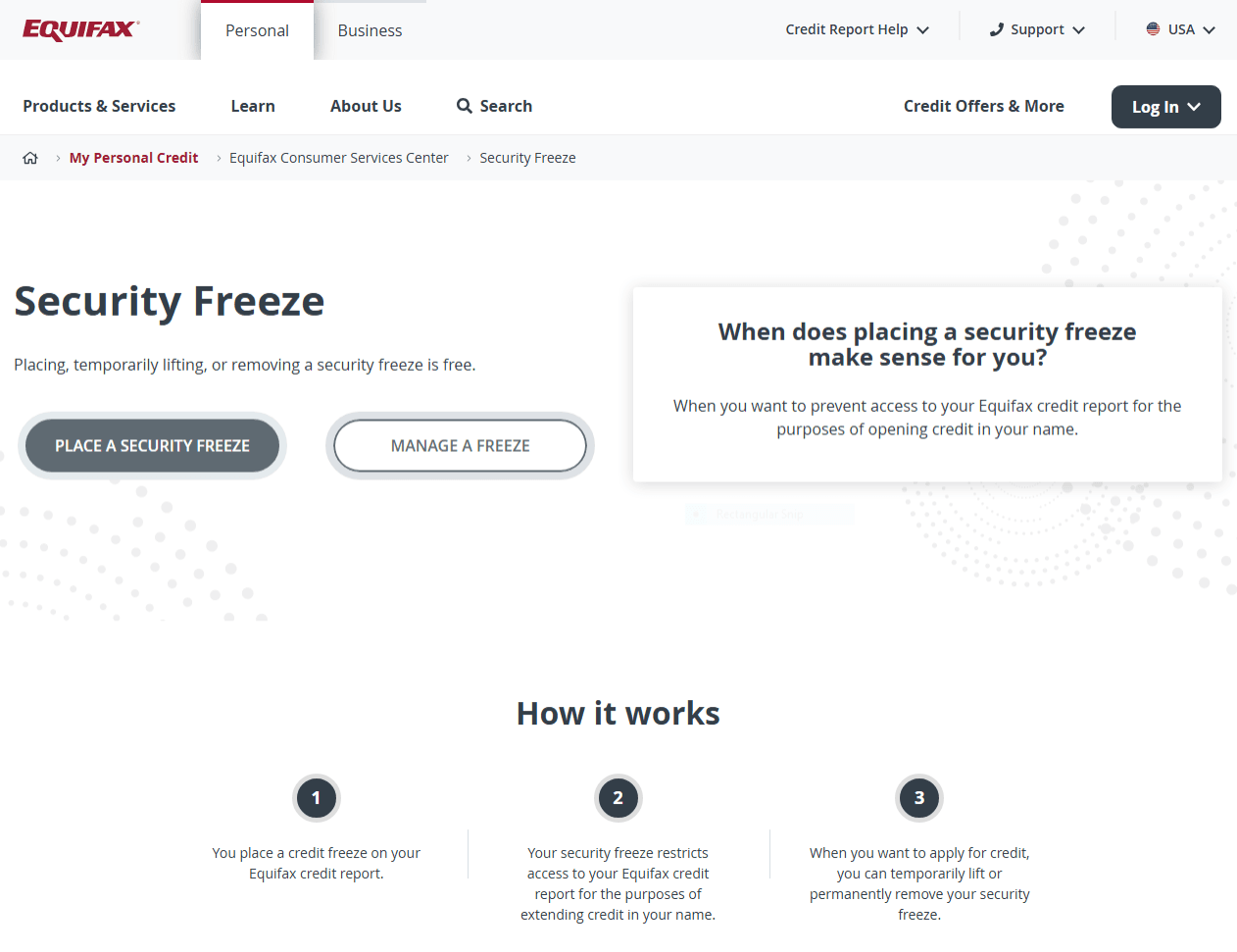

1. Freeze Your Credit at Equifax

🔗 Visit Equifax Credit Freeze Page

Steps:

- Click “Place a Freeze”

- Sign in or create an Equifax account

- Go through the ID verification process

- Confirm your freeze is active

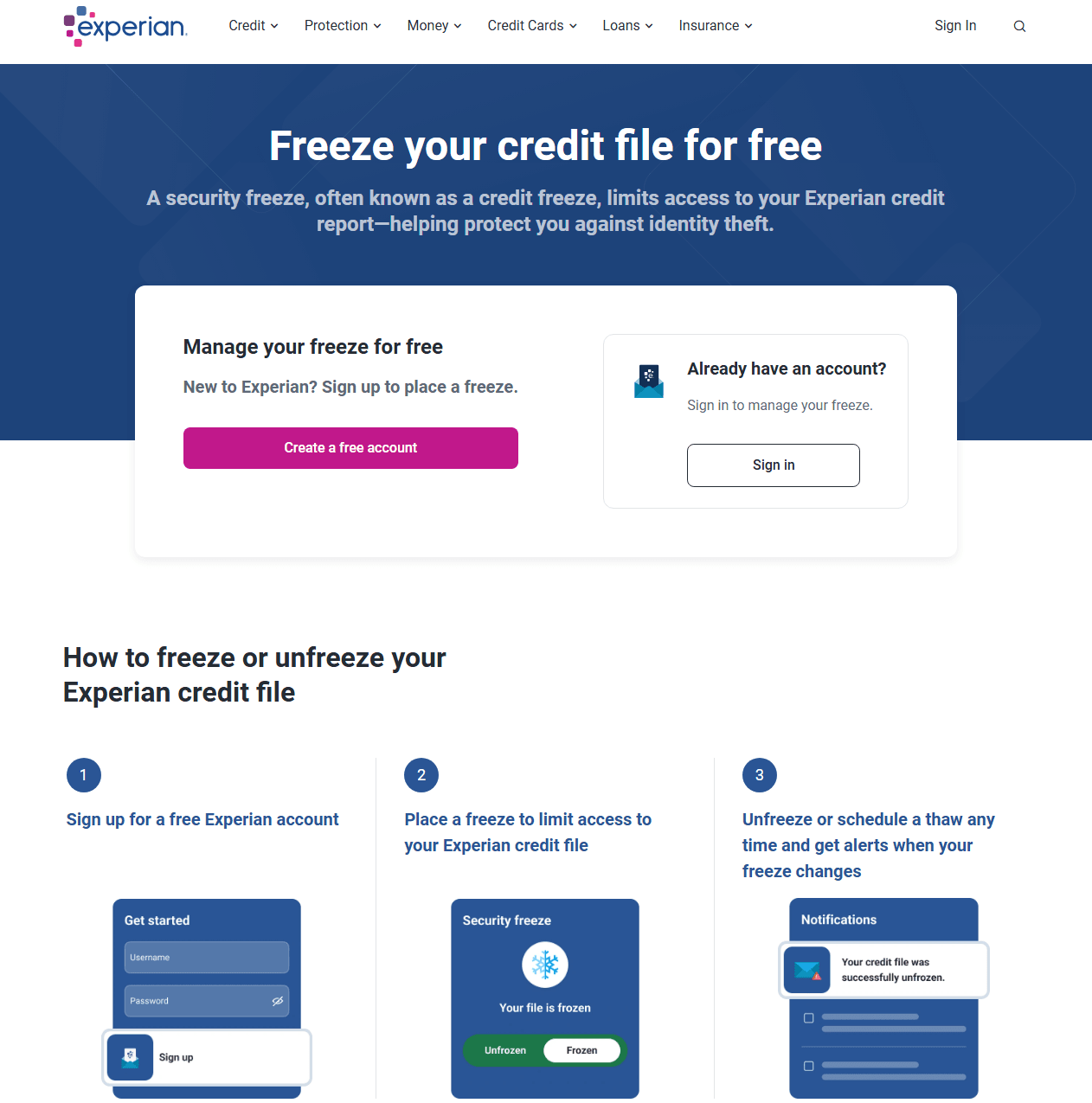

2. Freeze Your Credit at Experian

🔗 Visit Experian Freeze Center

Steps:

- Click “Add a Security Freeze”

- Log in or create a new account

- Enter your personal information

- Complete the verification process

- Confirm the freeze

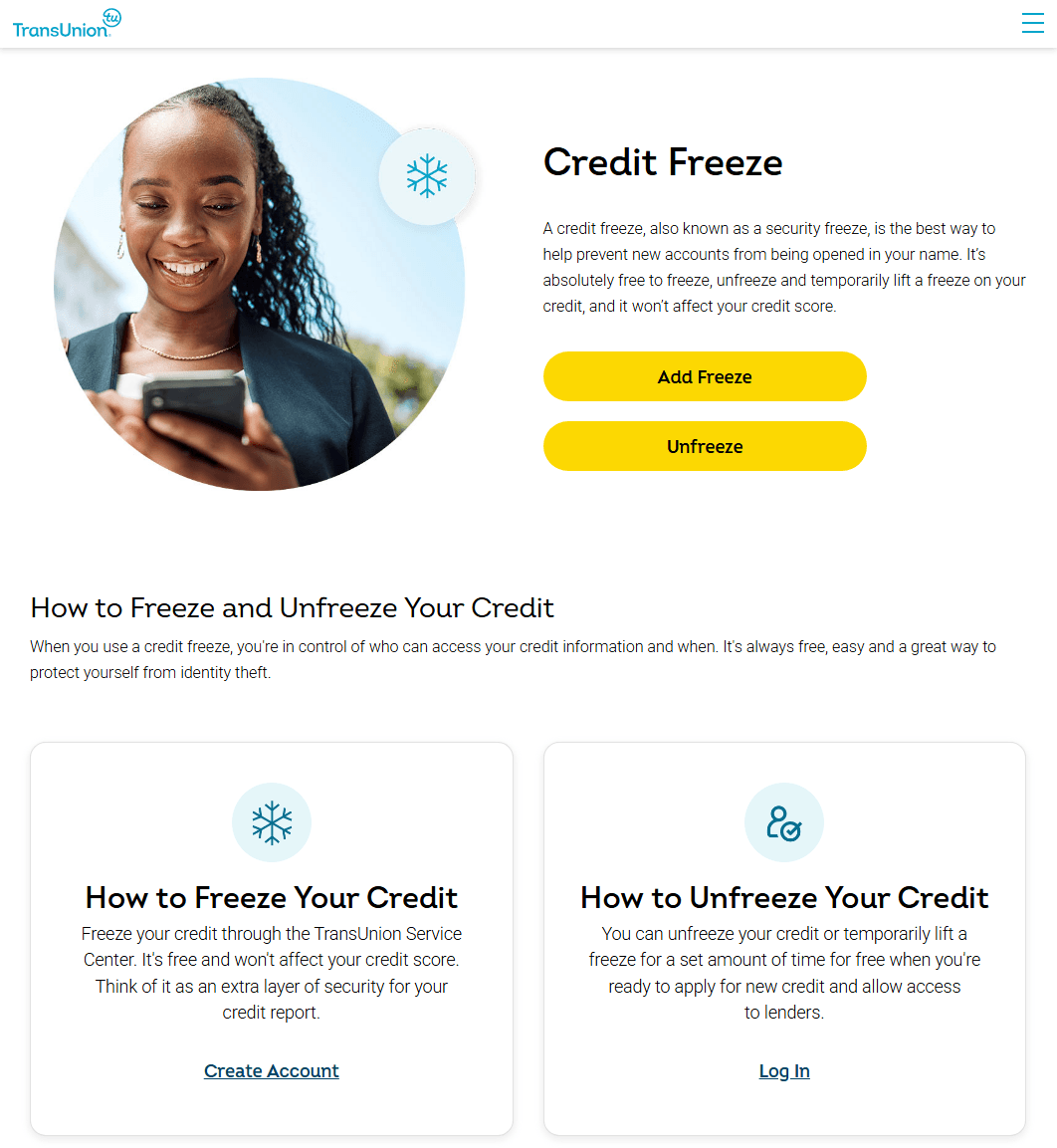

3. Freeze Your Credit at TransUnion

🔗 Visit TransUnion Freeze Page

Steps:

- Click “Start Freeze”

- Log in or create a TransUnion account

- Verify your identity with security questions

- Confirm the freeze

✅ How to Unfreeze Later

If you need to apply for a loan or background check, each bureau lets you temporarily lift the freeze. Just log in and unfreeze your credit for a set time.

🔐 Pro Tip: Use a password manager to securely store your login info and any PINs.

🔁 Final Checklist

✔️ You’ve visited and frozen your credit with all three bureaus

✔️ You’ve saved confirmation emails or screenshots

✔️ You’ve stored login credentials somewhere safe

🧨 Done in 10 Minutes — and You Just Made Life Way Harder for Identity Thieves.

Freezing your credit won’t stop data breaches, but it will block scammers from opening new accounts, loans, or cards under your name. And that’s a win.